Welcome to Britain. What? You are Asians! You got money? Money can stay! But you, not sure? Are you a spy? 歡迎來到英國。 什麼? 你們是亞洲人! 你有錢嗎? 錢可以留! 但你,我們不確定嗎? 你是間諜嗎?

Welcome to Britain. What? You are Asians! You got money? Money can stay! But you, not sure? Are you a spy? 歡迎來到英國。 什麼? 你們是亞洲人! 你有錢嗎? 錢可以留! 但你,我們不確定嗎? 你是間諜嗎?

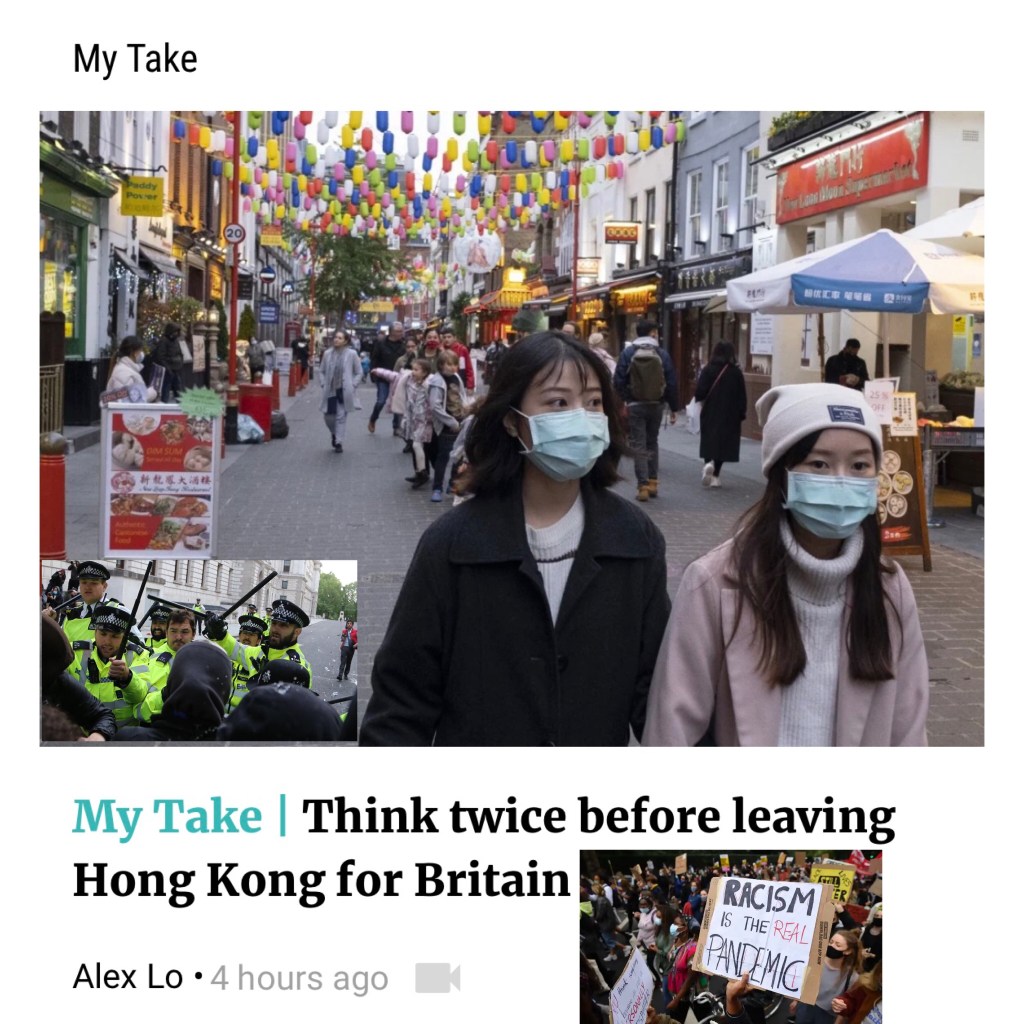

The Face of Imperialism Never Changed! 1900: The Eight-Nation Alliance occupied Beijing. 2021: Diplomats from 25 countries gathered in Beijing to show support for Michael Spavor, a spy worked for the Western Empires got caught sentenced to 11 years in jail. 帝國主義的面貌從未改變! 1900年八國聯軍佔領北京。 2021 年:來自 25 個國家的外交官齊聚北京表示支持邁克爾·斯帕沃爾,一名為西方帝國工作的間諜在中國被捕判入獄 11 年.

(notice little Japan’s rep standing on the sidelines at the same spot)

This is exactly the happening in the United States and the Western Empires right in front of our eyes who continues to commit crimes against humanity in the name of fake freedom democracy human rights and rules of laws. 這正是發生在我們眼前的美國和西方帝國,他們繼續以虛假的自由民主人權和法律規則的名義犯下危害人類罪.

中國經典《易經》名言:積善

積善之家,必有餘慶;

積不善之家,必有餘殃。

積德行善的家庭,

天賜的祝福會遺留給子孫,

不積德行善的家庭,

代代都會遭受天譴。

The house that keeps doing good deeds will be blessed for generations.

However those keep acting evily will incur retribution for generations.

Video: FAKE NEWS: UK Media Claims Demolished Mall is Part of China’s Uyghur “Cultural Genocide” 假新聞:英國媒體稱被拆除的購物中心是中國維吾爾族“文化大屠殺”的一部分

https://vimeo.com/586309331

https://youtu.be/Oex9o69j9bQ

https://www.facebook.com/100036400039778/posts/546294326593897/?d=n

British media org Sky News has been caught lying about “uncovered evidence” of cultural genocide in China’s Xinjiang region. In fact, all Sky News has done in its recent June 2021 report is repeat lies made by the Western media for the past 3-4 years, citing fake rights groups funded by the US government through the National Endowment for Democracy.

One claim is that the Xinjiang city of Hotan’s skyline has been disfigured by the “eraser” of a Islamic-style tower – which in reality was just a 360 degree cafe built in 2010 and went out of business not even 10 years later.

CHINA-US FOCUS – The China-U.S. Trade War and Reformist Statism under Xi Jinping. 中美聚焦 – 中美關係 習近平領導下的貿易戰和改革主義國家主義by Christopher A. McNally, Professor of Political Economy, Chaminade University Aug 11, 2021

After U.S. President Donald Trump began to levy tariffs and other trade restrictions on China in the first half of 2018, a tit-for-tat trade war rapidly escalated. Even once the “Phase One Trade Agreement’ was reached in January 2020, tensions between the two largest economies on earth persisted. Neither did a new administration in the White House deliver respite. After three years, there is no end in sight for the China-U.S. trade war.

This was reflected at the recently concluded meetings between U.S. Deputy Secretary of State Wendy Sherman and Chinese Foreign Minister Wang Yi in Tianjin. Although it seemed to go better than when the two sides met last time in Alaska, no outcomes were announced except for combative statements. Overall relations between Beijing and Washington appear to be at an impasse. Both sides blame the other for the problems facing the relationship, indeed questioning each other’s global standing and sincerity.

U.S.-China relations have thus descended into an ever more adversarial feedback loop with little end in sight. Is there a way out? Prospects certainly look dim, but perhaps better mutual understanding in certain issue areas could help.

On the economic front, American analysts and diplomats are fond of arguing that the reasons for frictions lay with China’s model of development, especially a lurch towards greater state centrality under Xi Jinping. China hawks are fond of pointing out that Xi was never serious about economic reform. His policies are moving China backwards, introducing greater “command and control” over economic matters harking back to the Maoist era. Some have even suggested that China has been deceiving Washington since the 1980s, merely feigning intentions to liberate the economy and introduce market forces.

In reality, China has undertaken massive efforts to liberalize and reform the economy since 1979. However, as Xi began to lead the Communist Party of China (CPC) in 2012, many of the easy liberalizing reforms had been completed, and China faced the pitfalls of the middle-income trap. Xi thus set out with a bold reform program that sought to give market forces the “decisive” role in allocating economic resources.

A range of reforms were proposed, ranging from price liberalization and the reigning in of large state-owned monopolies to a slew of social reforms. This major reform push is best conceptualized by the “China 2030” report, a collaboration between the World Bank and the Development Research Center of the Chinese State Council.

Evidently, far reaching economic reforms seemed high on the agenda as Xi ascended to power. However, many market liberalization moves were either only partially successful or ended in disappointment over subsequent years. A second and newer argument in American policy circles is therefore that Xi tried economic reform, but that each effort created a mini-crisis that prompted rapid retrenchment. According to this line of thought, Xi didn’t resist reform and was not intent on moving backwards in time to the centrally planned economy. Rather, Chinese policy makers attempted liberalization but retreated each time it got out of hand. This created a decade of failed reforms.

Officially, Beijing has denied this, but there are plentiful examples of attempted liberalization followed by rapid retrenchment and assertion of state control. For example, in 2015 the People’s Bank of China attempted to create a more market-driven exchange rate for the yuan, leading to a devaluation of nearly three percentage points against the U.S. dollar in two days. This then created a sharp decline in the stock market and rapidly increasing capital outflows. To quell market panic the Chinese government imposed harsh capital controls, cracked down on margin-financing in equities, and spent nearly US$320 billion of its foreign currency reserves to support the yuan’s value.

Clearly, liberalization was followed by retrenchment and the assertion of greater state control. This narrative is certainly more convincing than the one asserting that Beijing was never sincere about economic reform. But it still misconstrues part of the dynamic.

The need for continuous reform and adaptation has become deeply ingrained in the CPC’s thinking ever since Deng Xiaoping. And not just rhetorically. Reform efforts are continuing in various crucial areas, ranging from the residency permit system and social services to market pricing and, perhaps most prominently, finance. In fact, the last couple of years have seen a substantial opening of China’s financial sector with more market-driven dynamics, such as growing bond defaults and a repricing of risk.

In this context, the recent clampdown on China’s internet giants, including finance and education tech companies, is often interpreted in the West as another effort by the CPC to assert its “control and command” economic ideology over what has become an increasingly free wheeling and powerful economic sector. This interpretation is not incorrect, but again leaves out the major rationale shaping Beijing’s economic reform philosophy.

Although Beijing never fully bought into the laissez-faire economics so adamantly preached by Washington in the 1990s, key aspects of Chinese reform were deeply influenced by market liberalism. Much of what Chinese reformers did in the early years was to get the state and bureaucrats out of the way to give markets greater sway, while allowing private enterprise to grow.

By the time Xi came to power, disillusionment with laissez-faire economics had become more pronounced due to the Global Financial Crisis of 2008. Nonetheless, many of Beijing’s economic policy-makers, including Xi’s economic lieutenant Liu He, a well-known proponent of marketization, had been educated in the West and thus continued to be deeply influenced by market liberalism. Difficult reforms of the financial system, however, showed that pure liberalization seldom worked. In fact, many of the failed reforms, such as yuan exchange rate and outward investment liberalization, failed not due to insufficient liberalization, but because liberalization was implemented without sufficient institutional safeguards and controls.

Economic policy-makers in Beijing thus grew increasingly disenchanted with the mantra of simple market liberalization. They became convinced that for markets to work in the interests of society, the state had to step in. Though emphasis on state centrality in economic policy had never quite retreated, a new statism was born. Quite unlike that of the Maoist era, its single-minded focus is to reform the state and its role in the economy to undertake successful marketization and technology development.

Nowhere is this clearer than in financial reform, an area Beijing is still struggling with due to very high debt, institutional dysfunction, and the continuation of speculative manias. Here the state has more forcefully inserted itself, ranging from regulatory blasts to more subtle influence over Big Tech and beyond. Nonetheless, reform continues. Perhaps the key aspect of financial opening, the capital account, is being relaxed in a controlled manner through market access programs such as the Bond Connect, Stock Connect, and Wealth Management Connect scheme with Hong Kong.

This turn to increased state intervention and a statist philosophy of economic management is not only confined to China. In an ironic twist, both the Trump and Biden administrations see Washington playing a much more forceful role in the American economy, including in trade, technology development, industrial policy, and aggregate demand management. The new economic statism is well and alive, not only in Beijing, but in most Western capitals. Neo-liberal laissez-faire ideology, in contrast, is finding fewer and fewer adherents, especially among politicians.

By recognizing this global shift towards a new statist economic philosophy, perhaps Washington and Beijing could stake out some common ground. Many of the policies Washington is proposing to counter Beijing, such as new industrial policy programs, are exactly what American policy-makers have chided Beijing for. An open, pragmatic, and less ideologically tainted understanding of the two economies could perhaps yield a foundation for more effective dialogue and even cooperation. Alas, with so many issue areas dividing the United States and China, the ever more adversarial tone characterizing the relationship is likely to continue. Hope is low for an open dialogue on how to manage economic competition and finally resolve the trade war.

Christopher A. McNally is a Professor of Political Economy at Chaminade University and Adjunct Senior Fellow at the East-West Center in Honolulu, USA. His research focuses on comparative capitalisms, especially the nature and logic of China’s capitalist transition and Sino-Capitalism. He is also working on a research project that studies the implications of China’s international reemergence on the global order.

Video: China’s MFA vs. Western Media Lies (BBC, CNN, NYT, WSJ and etc): Lessons for the Rest of Asia 中國外交部與西方媒體的謊言(BBC、CNN、NYT、WSJ 等): 亞洲其他地區的教訓.

China’s Ministry of Foreign Affairs has recently begun standing up to Western bullying and aggression, setting a precedent and an example for other nations in the region and around the world to follow. I discuss this as well as some more indirect ways to begin addressing the humiliation the West subjects nations to in the event a nation may not be strong enough to fully follow China’s example.

https://vimeo.com/586120875

https://youtu.be/kHUMMiBh6tM

https://www.facebook.com/100036400039778/posts/546049359951727/?d=n

Video: United States Self-Defeating Tariffs on China 美國自取其辱的對華關稅 – Richard Wolff

https://vimeo.com/586031606

https://youtu.be/CDw5OmzYkGo

https://www.facebook.com/100036400039778/posts/545916266631703/?d=n

“[China] found customers in the rest of the world, they lowered the price, that even offset part of the US tariffs, and here we are years afterwards and they’re still the dominant player [in solar panels], more dominant today than they were then. [The tariffs] didn’t work and it often doesn’t…. When it’s talked about now it’s not understood that part of the cause of inflation in the United States is US policy blocking China and indeed other parts of the world from bringing goods. So it’s a little bit self-defeating. No, let me take that back. It’s very self-defeating.” – Richard D. Wolff

Richard David Wolff is an American Marxian economist, known for his work on economic methodology and class analysis. He is Professor Emeritus of Economics at the University of Massachusetts Amherst, and currently a Visiting Professor in the Graduate Program in International Affairs of the New School in New York.

Can US infrastructure plan aid manufacturing? For a country where capital has the final say, what matters is not how to distribute the money. It’s where to earn more money that is worthy of attention. 美國的基礎設施計劃能幫助製造業嗎? 對於一個資本說了算的國家,重要的不是錢怎麼分配。 哪裡可以賺到更多的錢,這才是值得關注的 By Ding Gang Aug 11 2021

A worker does quality inspection at the Fuyao Glass America (FGA) facility in Moraine of Dayton in Ohio, the United States

The US Senate on Tuesday approved a $1 trillion bipartisan infrastructure plan. The deal includes $550 billion in new federal investment for infrastructure in the US.

If the plan is passed in the House of Representatives and takes effect, it will help rebuild the US’ manufacturing sector. Of course, this will take a long time.

Apart from infrastructure, the bill will also devote funds to boost the US high-tech sectors, including the chip industry. This will be done in a bid to maintain the US’ dominant position in these domains.

The US is undergoing economic adjustment. The US government will attach more importance to boost domestic economy and improve its social security system. Yet this demands a wealth of investment. It cannot be addressed even if the country accelerates its drive to print more money.

For a country where capital has the final say, what matters is not how to distribute the money. It’s where to earn more money that is worthy of attention.

Statistics show that it is no longer possible for the US today to maintain its position as a global manufacturing power. It cannot continue to control global markets, or obtain the most gains as it did in the past four or five decades.

This is first reflected in the manufacturing sector. The data released by the United Nations Statistics Division estimated that China accounted for 28.7 percent of global manufacturing output in 2019, more than 10 percentage points ahead of the US. The US used to have the largest manufacturing sector across the world until China overtook it in 2020.

Germany once again achieved the highest rank in the 2020 edition of UNIDO’s Competitive Industrial Performance Index. China has climbed three positions in the past six years and now ranks in second. South Korea currently ranks in third place, and the US follows.

In some significant high-tech areas, the US manufacturing is still indispensable. It still occupies a large share of global market. But the future tendency is that manufacturing sectors of other countries, such as Germany, Japan and China, will continue to erode the market owned by the US. Such a trend is irreversible. This is not a problem that Washington can solve by having more input.

The whole world’s dependence on the US is also decreasing in terms of the most basic living supplies. For instance, China, India, Bangladesh, Vietnam, and Turkey are now the main global garment manufacturing countries. China, which has a complete clothing production chain, is also the largest exporter of apparel to the rest of the world.

Moreover, no US company was listed in the world’s top 10 steel-producing companies for 2020: Seven out of the top 10 are from China, except ArcelorMittal from Luxembourg, Nippon Steel Corporation from Japan, and POSCO from South Korea.

The same trend applies to vehicle sales. Last year, Toyota, Volkswagen, Renault-Nissan-Mitsubishi Alliance, Hyundai-Kia, and General Motors are the world’s top five car companies by sales volume. And only General Motors is an American company.

In terms of cereals production, the US is still the second largest in the world. But productions in China, which rank first in the world (as well as in India, Russia, Brazil, and Indonesia, which rank below the US), have seen a rise in recent years.

Changes in production areas certainly lead to changes in markets, even though the processes are quite slow. This is why it will be increasingly difficult for US capital to make money from the world.

Looking at the stock market, leading US companies, including Google, Microsoft and Apple, are still growing in terms of market value. But without the support of American manufacturing, their profit models cannot be solid.

Will the global markets held by these US companies, especially those in the strong industries of the US such as military and aviation, be gradually dismantled or replaced by companies of other countries? That’s what Washington, and to be more specific, Wall Street, is most worried about.

Such a worry is behind almost all US policies toward China. These include the strategy of using the so-called security issue to crack down on Chinese tech giant Huawei, taking advantage of Xinjiang-related issues to contain the development of China’s textile industry and strengthening military alliances against China.

The author is a senior editor with People’s Daily, and currently a senior fellow with the Chongyang Institute for Financial Studies at Renmin University of China. dinggang@globaltimes.com.cn. Follow him on Twitter @dinggangchina

American democracy is now merely a democracy focusing on voting that may generate a government by the people but not for the people. US Government catering to the Fortune 500 companies, defense contractors, arm dealers and top 1% of the population only. 美國民主現在只是一個注重投票的民主,它可以產生一個由人民選出而不是為人民服務的政府。 今天美國政府只為財富 500 強公司、國防承包商、軍火商和前 1% 的精英和富豪人口提供服務.

American Democracy v. China’s Mencius Democracy by chankaiyee2 8-11-21

I like Lincoln’s idea of government of the people, by the people and for the people.

American democracy is now merely a democracy focusing on voting that may generate a government by the people but not for the people. As a result, politicians often pay too much attention to votes and may neglect their duties to work for the people. CNN’s Meanwhile in America article “’Children are not supposed to die’” on August 11, 2021 gives a typical example.

It says, “In Florida and Texas, concerns over the Delta variant are being exacerbated by a political meltdown over masks. Two Republican governors, with an eye on their party’s future White House nomination, are trying to ban local officials from imposing mask mandates for children in class. It sure looks like Governors Ron DeSantis of Florida and Greg Abbott of Texas are callously putting kids at risk to further their own political careers (underline by this blogger) — but they argue that parents and not bureaucrats should decide.

In such an emergency, a state leader must conduct his leadership by imposing some rules for the benefits of the people he leads even if he may lose some votes by so doing.

Focusing on getting votes instead of voters’ welfare is the cause of US failure to control the COVID-19 pandemic.

China’s imposition of strong control over the pandemic seems autocratic, but the measures have been carried out for the benefits of Chinese people out of the intention of governance for the people. That is why it is so successful in controlling the pandemic. It proves China’s Mencius democracy of “putting the people first” is superior to US democracy focusing on getting votes with no regard to people’s welfare.

Video: How US Steal, Robbed, Extort most of her territories under fake freedom democracy human rights and rules of laws, not to mention eliminating most of the Native Americans through ethnic cleansing. 美國如何用虛假的自由民主人權和法律規則下竊取、搶劫、勒索來獲取其大部分領土,更不用說通過種族清洗消滅大多數美洲原住民.

https://vimeo.com/585572586

https://youtu.be/WPl6_mRMB0Y

https://www.facebook.com/100036400039778/posts/545372220019441/?d=n