Western financial sanctions on Russia provide China with a rare opportunity to understand and plan for the future. 西方對俄羅斯的金融制裁為中國提供了一個了解和規劃未來的難得機會.

The implications of Western sanctions against Russia for China

By Yu Yongding(余永定)is an academician at the Chinese Academy of Social Sciences, and former member of the Monetary Policy Committee of the Central Bank

Since the outbreak of the Russian-Ukrainian military conflict, the United States and its allies have attempted to create severe financial turmoil by imposing financial sanctions on Russia in order to deter Russian military action or even induce regime change. According to Yu Yongding’s analysis, the financial sanctions have not met the expectations of the West. The Western financial sanctions remind China, which has around US$3.2 trillion in foreign exchange reserves and is the second largest creditor to the US, that it should plan ahead and think seriously about ways to maintain China’s financial security.

Key points

Generally, financial wars start with an attack on a country/region’s currency, as was the case in the 1998 Hong Kong financial crisis. The US, EU, and its allies announced the weekend of February 27 that they would freeze Russia’s foreign exchange reserves. Their aim was to make it impossible for the Central Bank of the Russian Federation to access its US$630 billion ‘war chest’ to stabilize the ruble which fell sharply after Russia launched military actions in Ukraine in February.

Russia was able to stabilize the ruble in less than a month (February 28- March 24) through countermeasures such as interest rate hikes, capital controls, and requiring sanctions-supporting countries to buy oil in rubles. The resulting Western sanctions have largely failed in the short term.

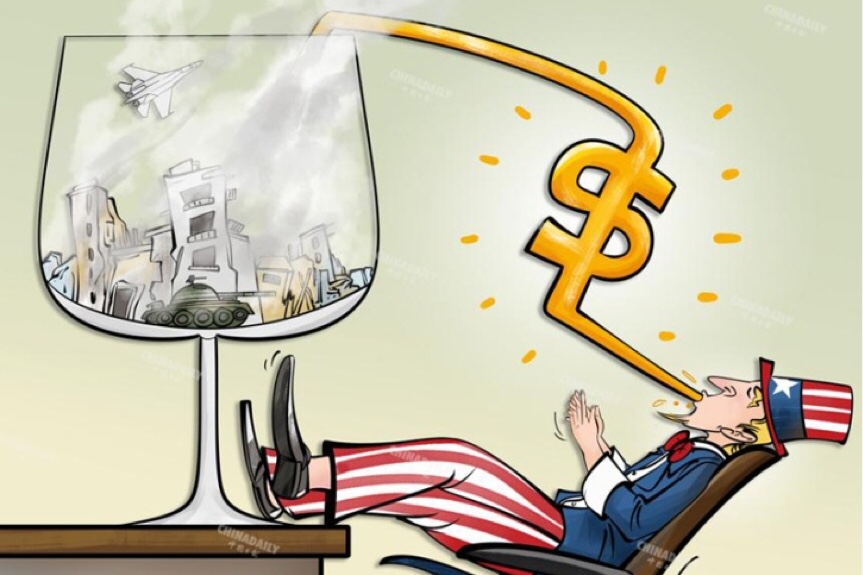

The financial sanctions by the US and its allies illustrate that the global financial system and the US dollar have been weaponized into geopolitical tools. The nefarious behavior of the US in freezing foreign exchange reserves has not only seriously damaged the international credibility of the US but has also shaken the credit foundation of the dominant international financial system in the West.

If there is a geopolitical conflict between the US and China, then China’s overseas assets will be seriously threatened, especially its huge reserves. Therefore, the composition of China’s external financial assets and liabilities urgently needs to be adjusted and the portion of US dollar denominated assets in its reserves portfolio should be reduced.

Summary

The author points out that it is not the first time that the US and its allies, the self-proclaimed “defenders” of international rules, have frozen the foreign currency reserves of other countries. The US froze about US$7 billion in assets held in US financial institutions by the Afghan central bank, claiming to use half of them to compensate the victims of 9/11. Western financial sanctions provide China with a rare opportunity to understand and plan for the future. The country’s reserves now substantially exceed the levels required for precautionary purposes or for self-protection against the currency crisis. It should reduce its holdings of US Treasuries in the future, increase its imports of commodities and strategic materials, cut its excessive war chest, and accelerate the security of its overseas assets, especially international reserves.