China’s SMIC Is Closing The Gap With Industry Leaders Despite U.S. Sanctions 儘管受到美國的製裁,中國的中芯國際正在縮小與行業領導者的差距 – ETSemiconductor Manufacturing International Corp. ADR (SMICY) TSMUMC by Dr. Robert N. Castellano, Aug. 11, 2021

Summary

Sanctions against equipment sales to China capable of generating semiconductors with dimensions under 10nm continues under Biden.

China’s SMIC on the U.S. entity list, has had its high-end business stymied by the mandated cancellation of ASML’s EUV lithography.

SMIC instead has been closing the gap against Taiwanese competitors TSMC and UMC at the cost-effective 28nm node used in automobiles and aerospace.

Non-Chinese equipment companies are benefiting from the sanctions Chinese companies hoarding equipment.

Chinese equipment companies will be the long-term beneficiaries as technology improves, particularly lithography.

This idea was discussed in more depth with members of my private investing community, Semiconductor Deep Dive.

Chinese foundry Semiconductor Manufacturing International Corp. (SMIC) (OTCQX:SMICY) generated $1.34 billion in revenue in Q2 2021, up 21.8% from the prior quarter and an increase of 43.2% on a yearly basis. The firm’s gross profit hit $405 million, a 61.9 % QoQ and a 62.9% YoY increase. The chipmaker’s gross margin also rose to 30.1% in the second quarter from 22.7% in the first quarter.

Revenue guidance for Q3 is expected to grow just 2% to 4% sequentially, and gross margin is expected to range from 32% to 34%. Readers must recognize that SMIC is on a U.S. export control blacklist.

SMIC Before the Sanctions

It wasn’t always that way. On July 17, 2020, prior to the U.S. sanctions, I published a Semiconductor Deep Dive Marketplace subscription article entitled “China: Who Needs TSMC When They Have SMIC?” I noted in the article bullets:

With U.S. government restrictions on China’s Huawei, SMIC will take over production of Kirin modem chips at 14nm from TSMC (TSM) at 7nm.

SMIC, the fifth-largest pure-play foundry, will be able to produce chips at 7nm even without EUV lithography, as early as next year.

SMIC’s n+1 process already offers performance at 14nm close to TSMC’s at 7nm.

Six weeks later on September 4, 2020, Reuters reported the Trump administration was considering whether to add China’s top chipmaker SMIC to a trade blacklist, as the United States escalated its crackdown on Chinese companies. The rationale was SMIC’s relationship to the Chinese military.

Then in December, SMIC was added to the U.S. Commerce Department’s Entity List. The Entity List designation requires U.S. exporters to apply for a license to sell to SMIC. “Items uniquely required to produce semiconductors at advanced technology nodes — 10 nanometers or below — will be subject to a presumption of denial to prevent such key enabling technology from supporting China’s military-civil fusion efforts,” the US Commerce Department said.

There are Chinese equivalents for all major semiconductor capital equipment firms. Chinese businesses bought almost $32 billion of equipment used in 2020 to produce computer chips from Japan, South Korea, Taiwan and elsewhere, a 20% jump from 2019.

But the important takeaway is that Chinese equipment companies will continue to improve performance, and Chinese semiconductor manufacturers will buy Chinese equipment preferentially over foreign manufacturers. This will present a long-term headwind for foreign equipment suppliers.

SMIC’s Competitive Performance

The limitations of Chinese equipment and the ban on foreign equipment <10nm has forced SMIC to focus on mature technologies that are more profitable.

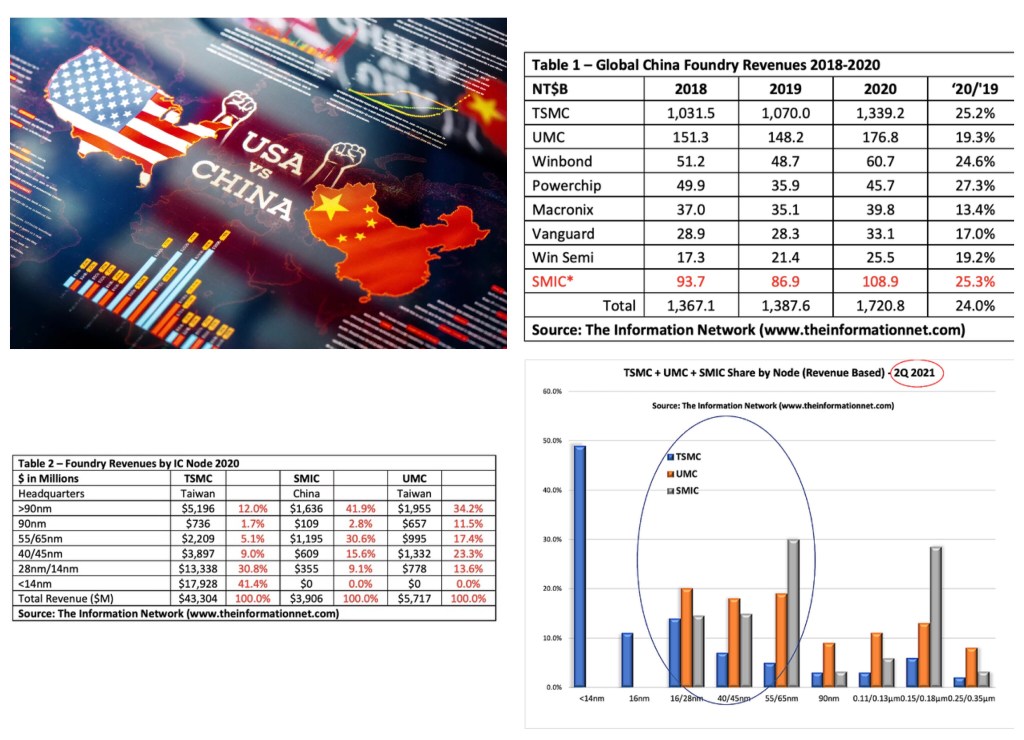

In Table 1, I detail foundry revenues from 2018-2020 for Global China foundries, which are predominantly headquartered in Taiwan. For SMIC, which is Mainland China-based, I converted revenues to New Taiwan Dollars (NTB$).

SMIC, impacted by U.S. sanctions, grew 25.3% YoY in 2020, ahead of TSMC and all other foundries except for Powerchip.

In Table 2, I segmented 2020 revenues by IC node for TSMC, SMIC, UMC (UMC). The point of this table is to show the different emphasis each foundry has in chip production.

These data points are fluid. For example, Table 2 shows that in 2020 TSMC registered 30.8% of revenues from chips made at the 28nm/14nm nodes and 41.4% at <14nm. In Q2, 2021, that share changed to 25.4% for the 28nm/14nm nodes and 48.8% at <14nm, as will be shown below.

In Chart 1, we can see that for the most recent quarter, in the 28-65nm node region, SMIC (grey bars) generated 30% of revenues at the 55/65nm nodes and just 15% at the 28nm node. UMC’s (orange bar) revenues for the three nodes ranged from 18% to 20%.

As for TSMC, they dominate the <14nm node. Note that the company segments the nodes by 16nm and 28nm, as opposed to the other two companies that combine them. TSMC’s share at 28% was lower than both competitors in 2Q 2021, as the company focused on <14nm (increasing from 36% to 49%) and 16nm was 11%.

Chart 1

The improvements in SMIC’s output in 2Q 2021 vs CY 2020 (Table 2) are significant and will continue as its new fabs begin production. SMIC’s new Beijing plant, with a total investment of nearly 50 billion yuan, is expected to start operations in 2024, with monthly production capacity of 100,000 12-inch silicon wafers. The new Shenzhen plant, meanwhile, is expected to start production in 2022, with a monthly capacity of 40,000 12-inch wafers.

Investor Takeaway

A report from the US Semiconductor Industry Association and Boston Consulting Group warns that strategic decoupling from China could backfire, resulting in a slowdown of innovation, lost market share and a vast escalation of China’s manufacturing capability. The U.S. may simply be stimulating the competition it wishes to starve.

Nevertheless, equipment sales continue at a strong pace to China except for systems capable of processing chips at the 10nm node and smaller. Equipment imports into China increased 22.6% QoQ. The largest growth in etch machines going into Samsung’s Xi’an NAND fab, according to The Information Network’s report entitled “Mainland China’s Semiconductor and Equipment Markets: Analysis and Manufacturing Trends.”

Strong domestic demand is helping it deliver robust earnings despite a U.S. crackdown that has restricted the company’s access to American technologies since last year. the chipmaker revised up its full-year revenue growth forecast to 30% as it continues to work with suppliers to alleviate the impact of U.S. export restrictions. SMIC previously predicted growth “exceeding mid-to-high single-digits.” It also raised its full-year gross margin forecast to around 30%, the highest level in years.

In light of sanction, SMIC’s has redirected its business model at increasing production on mainstream nodes rather than bringing advanced capacity online, putting its investment directly in competition with UMC’s range of production. SMIC undoubtedly appears to be gaining momentum and closing the gap between it and foundry industry leaders.

This free article presents my analysis of this semiconductor equipment sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here and start a risk free 2 week trial now.

This article was written by Robert Castellano, Author of

Semiconductor Deep Dive

Providing a deep knowledgebase for better semiconductor stock investments

http://www.theinformationnet.com

Semiconductors, Solar, Expert Witness

Contributor Since 2006

Dr. Robert N. Castellano, is president of The Information Network http://www.theinformationnet.com. Most of the data, as well as tables and charts I use in my articles, come from my market research reports. If you need additional information about any article, please go to my website.

I will soon be initiating an investor newsletter. Information to register will be online on my website.

I received a Ph.D. degree in chemistry from Oxford University (England) under Dr. John Goodenough, inventor of the lithium ion battery and 2019 Nobel Prize winner in Chemistry. I’ve had ten years experience in the field of wafer fabrication at AT&T Bell Laboratories and Stanford University.

I have been Editor-in-Chief of the peer-reviewed Journal of Active and Passive Electronic Devices since 2000. I authored the book “Technology Trends in VLSI Manufacturing” (Gordon and Breach), “Solar Panel Processing” (Old City Publishing), “Alternative Energy Technology” (Old City Publishing). Also in the solar area, I am CEO of SolarPA, which uses a proprietary nanomaterial to coat solar cells, increasing the efficiency by up to 10%. I recently published a fictional novel Blessed, available on Amazon and other sites.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Dr. Robert N. Castellano, is president of The Information Network http://www.theinformationnet.com. Most of the data, as well as tables and charts I use in my articles, come from my market research reports. If you need additional information about any article, please go to my website.

I will soon be initiating an investor newsletter. Information to register will be online on my website.

I received a Ph.D. degree in chemistry from Oxford University (England) under Dr. John Goodenough, inventor of the lithium ion battery and 2019 Nobel Prize winner in Chemistry. I’ve had ten years experience in the field of wafer fabrication at AT&T Bell Laboratories and Stanford University.

I have been Editor-in-Chief of the peer-reviewed Journal of Active and Passive Electronic Devices since 2000. I authored the book “Technology Trends in VLSI Manufacturing” (Gordon and Breach), “Solar Panel Processing” (Old City Publishing), “Alternative Energy Technology” (Old City Publishing). Also in the solar area, I am CEO of SolarPA, which uses a proprietary nanomaterial to coat solar cells, increasing the efficiency by up to 10%. I recently published a fictional novel Blessed, available on Amazon and other sites.