SCMP Columnist: My Take by Alex Lo – Beijing’s hard line is good for business in Hong Kong. The city as we have known it will be very different from now on. But prosperous it will be, now more so than ever. If you want to get ahead in the new Hong Kong, better learn to speak good Mandarin. 北京的強硬路線有利於在香港開展業務。 我們所知道的這座城市從現在起將大不相同。 但它將會繁榮,現在比以往任何時候都更加繁榮。 如果你想在新香港出人頭地,最好學會說一口流利的普通話。

Washington and the now-defanged local opposition predict Hong Kong’s international financial status will suffer, or even be irreversibly lost, because of Beijing’s crackdown.

Those who know something about money and finance, and have skin in the game, know the exact opposite will be the case. They may not say it out loud but many privately welcome the new development.

Critics of China may argue about the loss of the rule of law, Hong Kong autonomy and civil liberty. But you don’t need perfect rule of law, full autonomy or complete liberty for the city to function properly; you only need them to be “good enough” to render some predictability about the rules of the game for businesses, both local and international, to operate.

In a new paper titled “The Risks for International Business under the Hong Kong National Security Law” and published by the Ash Centre for Democratic Governance and Innovation at Harvard, Dennis Kwok, a former pan-democrat lawmaker and now a fellow at the institute, warns businesses face potential complications in legal disputes locally and extraterritorial jurisdiction abroad from China.

But business is all about risk. If foreign investors are willing to do business in mainland China, they will continue to operate in Hong Kong. If they can make money, they will come. Wall Street banks are already queuing to redirect lucrative Chinese IPOs from New York to Hong Kong.

The equities and real estate markets continue to be robust, despite the 2019 violent unrest, American sanctions and the Covid-19 pandemic. If these horsemen of the apocalypse can’t kill the city, nothing can, at least for now.

To be sure, the city as we have known it will be very different from now on. But prosperous it will be, more so than ever.

Its future success is guaranteed, now that the irritants of localist violence and the pan-democratic opposition have been neutralised. Its integration with the Greater Bay Area, already one of the world’s great economic growth engines, will speed up. Cross-border travels and settlements will increase, once the pandemic ends.

As Michael Schuman, the Hong Kong-based author of Superpower Interrupted, told Axios, the news website: “So long as there’s money to be made, money’s going to come here. The finance centre can run perfectly nicely here being run primarily by mainlanders.”

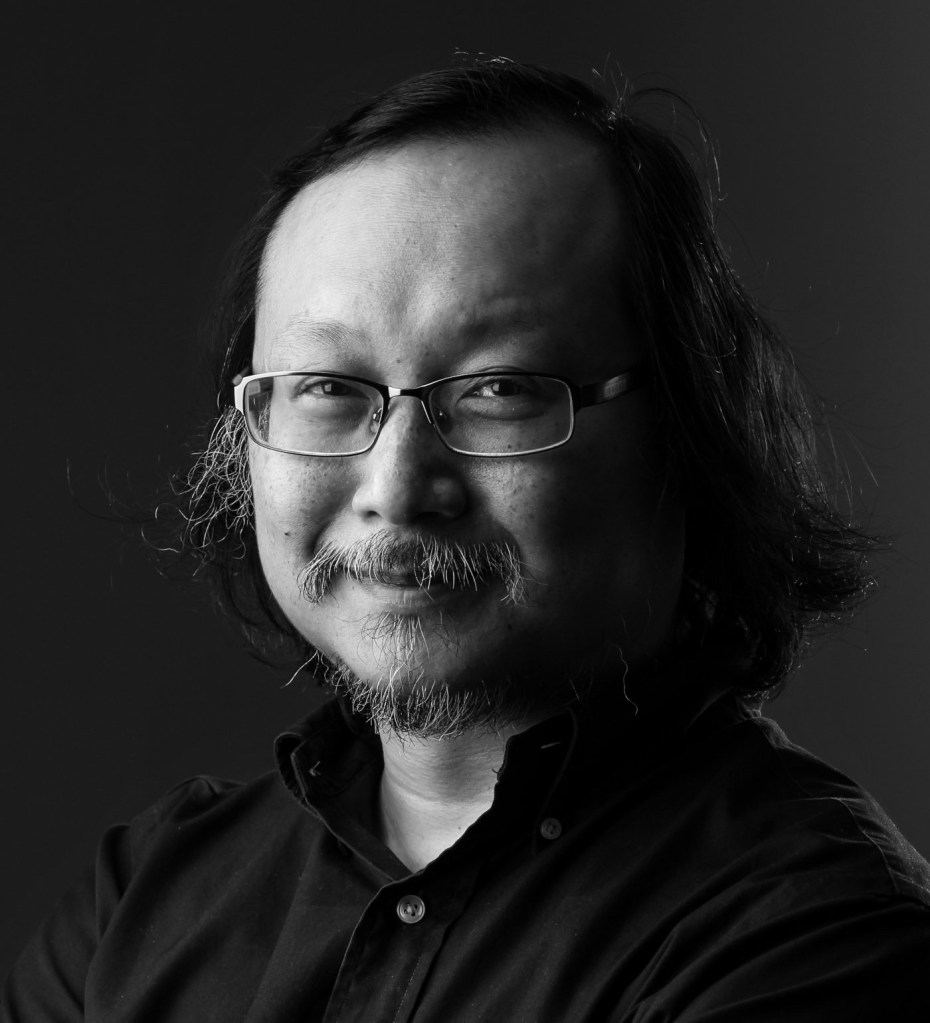

Alex Lo has been a Post columnist since 2012, covering major issues affecting Hong Kong and the rest of China. A journalist for 25 years, he has worked for various publications in Hong Kong and Toronto as a news reporter and editor. He has also lectured in journalism at the University of Hong Kong.