China to strongly repulse US ban on Xinjiang’s solar panel material companies by GT staff reporters Jun 24 2021

China on Thursday vowed to take all necessary measures to firmly safeguard the legitimate rights and interests of Chinese companies following the latest US crackdown on solar panel material producers based in Northwest China’s Xinjiang Uygur Autonomous Region, which produces around half of the world’s polysilicon.

Lawyers and experts encouraged relevant companies and the Chinese government to strongly strike back at the US’ unreasonable and baseless accusations after the US has obviously become aware of the sanction benefits of its “industry genocide” targeting businesses of Xinjiang’s cotton and tomato.

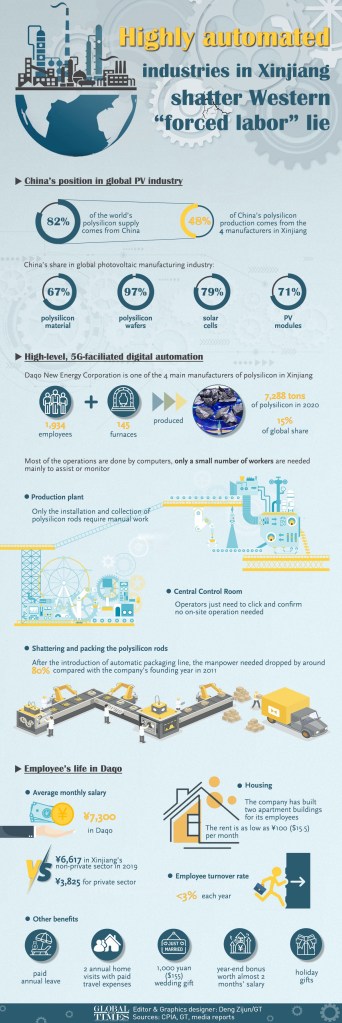

Highly automated industries in Xinjiang shatter Western “forced labor” lie

The fabricated “forced labor” issue in Xinjiang is contrary to reality and the accusation is “the lie of the century,” the Chinese Commerce Ministry and Foreign Ministry said on Thursday in separate remarks.

The US should immediately redress their actions, or “we will take necessary measures to resolutely safeguard the legitimate rights and interests of Chinese companies and institutions,” said Commerce Ministry spokesperson Gao Feng.

The US Commerce Department on Thursday put Hoshine Silicon Industry (Shanshan) Co, and three other Chinese companies – Xinjiang Daqo New Energy Co, Xinjiang East Hope Nonferrous Metals Co and Xinjiang GCL New Energy Material Technology Co, as well as the Xinjiang Production and Construction Corps on an Entity List, citing the baseless claim of “forced labor” in the region.

The Biden administration on Wednesday separately blocked imports of Hoshine Silicon Industry, US media reported.

Despite having shown automated production of polysilicon in its Xinjiang plant to Western financial institutions and media outlets like Bloomberg and Financial Times in May to debunk the “forced labor” allegations, Xinjiang Daqo was named on the US Entity List.

“Considering the US photovoltaic (PV) market only needs 10 percent of the world’s polysilicon, we don’t believe it will create a significant impact on our businesses,” Xinjiang Daqo told the Global Times on Thursday.

Reaffirming the company’s “zero tolerance on forced labor,” it said it has neither sold any products directly to US companies nor purchased any US products.

Xinjiang Daqo obtained approval to get registered on the Shanghai tech-heavy STAR market on Tuesday after its parent firm Daqo New Energy tumbled at the New York Stock Exchange partly because of the groundless US accusations. Shares of Daqo New Energy dropped around 4 percent to $55.7 in trading on Thursday morning session (US time).

A staff of the investor relations sector at Hoshine Silicon told the Global Times on Thursday that the company is gathering information about the impact of the US ban on its downstream customers, noting the company’s sales proportion in the US market was small.

Xinjiang region contributes around 45 percent of the world’s supply of polysilicon. As energy consumption is one of the key factors affecting polysilicon manufacturing, competitive electricity prices in Xinjiang, North China’s Inner Mongolia Autonomous Region, Southwest China’s Sichuan Province, Northwest China’s Qinghai Province and Ningxia Hui Autonomous Region make these regions attractive.

According to Hangzhou-based industry website pv.china-nengyuan.com, the polysilicon output in Xinjiang is expected to hit 300,000 tons this year, which could satisfy the solar energy demand of 60 gigawatts (GW). It is notable that China’s domestic PV module demand will reach 60-70 GW in 2021 as the country is striving to realize its “carbon peak” and “carbon neutrality” goals.

Unlike targeting Xinjiang’s cotton and tomato, the US sanctions on the region’s solar panel materials is not a whim as the past decade witnessed how the US solar industry went downhill while growth in China’s solar energy sector forged ahead, industry observers said.

They noted even if non-Xinjiang regions have the capacity to produce polysilicon, the higher costs and other disruptions would appear in the global solar supply chains under the US ban. For instance, the old facilities and polysilicon manufacturing equipment at foreign companies including REC Group, OCI Solar Power and Hemlock would create increasing uncertainties to the global solar industry.

China became the world’s largest polysilicon producer in 2020 with an output of 396,000 tons. Its global output share climbed to 76 percent of the world total, up 8.7 percentage points, according to data from the China Photovoltaic Industry Association.

The latest ranking from German research firm Bernreuter Research said seven of the world’s top 10 largest polysilicon producers are based in China and only one is American.